The Tesla Model 3 now costs just £27,000 in China, and domestic-market rivals are even cheaper

The dominant question fielded by automotive executives at the Shanghai motor show was not about cars, batteries or exports but about the price war that has raged in the country since the start of the year.

The event gave them the opportunity to offload about an issue that is worrying many. “This price war has had an impact on the whole industry,” said William Li, CEO of Chinese premium EV maker Nio, told journalists.

The trigger was pulled by Tesla, which in January cut the prices of its Model 3 and Model Y by up to 13.5%. This means the Model 3 now starts at just ¥229,900 (£27,000), placing what had been a premium car within the hot-contested midsize saloon segment into a strata that included more accessible models.

Both foreign and Chinese firms reacted accordingly. “It’s brutal under ¥300,000 [£35,000],” Tu Le, managing director of consultancy Sino Auto Insights, told Autocar. “Domestic EV companies are killing each other and the foreign legacies can’t even participate.”

Coming from Europe and the UK, the pricing of the latest EVs before discounts is eye-opening in China. The Model 3 costing the same as an electric supermini does over here is bad enough, but it gets worse when inspecting pricing for domestic makers.

At the Shanghai show, BYD, China’s largest EV maker, showed off its new Fiat Panda-size Seagull hatchback, which will go on sale from ¥79,800 (£9353). This isn’t another urban quadricycle but a genuine replacement for ICE equivalents with a base range of 190 miles.

There are discounts to be had on top. BYD was offering the equivalent of £1000 off its Seal saloon in March, cutting the start price to the equivalent of £24,000 for a car with a claimed range of 342 miles.

Those are the visible discounts. At dealer level, the giveaways are even larger, according to one executive at a China-based automotive company who didn’t wish to be named.

Rather than simulating the market, the discounts have the opposite effect. “A lot of consumers are waiting for a better deal,” Nio president Lihong Qin told journalists.

Wholesales (sales to dealers) in China over the first three months were down 7%, at 6.1 million, according to figures from the China Association of Automobile Manufacturers (CAAM). Retail sales were down 14%, with foreign firms receiving the brunt of the falls.

Some were pinning their hopes on the Shanghai show to end the price war. By giving consumers the chance to interact with new models after three years in which shows were either cancelled because of Covid or severely restricted, car makers hoped to get them excited about new technologies again. “We think the so-called price war is a short-term phenomenon,” Brian Luo, head of PR for BYD, told Autocar. “From April, there will be a lot of auto shows in China, and they help consumers realise what products they’re interested in.”

Luo predicted that the worst of the discounting would end after May.

Some foreign firms say they’re taking the same course of action in China as they have done in Europe when faced with Tesla’s price cuts: ignore them. “We aren’t cutting prices,” Lexus global brand head Takashi Watanabe told Autocar. “We would like to keep the value of the products rather than fight other competitors.”

Premium brands are viewing the war as happening below them. “The competitive intensity is increasing, but mostly it’s in the volume segment where Mercedes is not directly involved,” Mercedes-Benz CEO Ola Källenius told Autocar at the show. “We’re focused on value over volume at the moment”.

Walking around the Shanghai show revealed the competitive intensity in new model launches as well as pricing. Around 100 new cars were revealed to the public for the first time at the event, of which 70 were electric, according to figures seen by Nio.

Some clearly revealed the impact of Tesla’s price war. For example, the new Hyper GT saloon from GAC’s successful EV brand Aion was priced from ¥219,900 (£25,800), undercutting the Model 3. This was despite a range starting at 348 miles and some eye-catching technology, including multiple lidar sensors and scissor-action front doors.

Tesla was absent from the Shanghai show, despite building cars locally, but it was easy to see why: the brand might compete on price but not new metal. Its youngest product, the Model Y, is now three years old – a lifetime in Chinese model-launch cadence. “Tesla isn’t competitive any more,” Nio’s Li said. “Now for the same price you can get a better product than [a] Tesla.”

Price cuts were Tesla’s only real move, with no new models in the pipeline. “No one predicted how competitive and how fast-moving this market was going to be, not even the mighty Tesla,” Le of Sino Auto Insights said.

Can anyone afford to sell EVs in China at the prices they currently are? Tesla says it can and posted an 11.4% operating margin on $2.7 billion income in the first three months of the year to prove it.

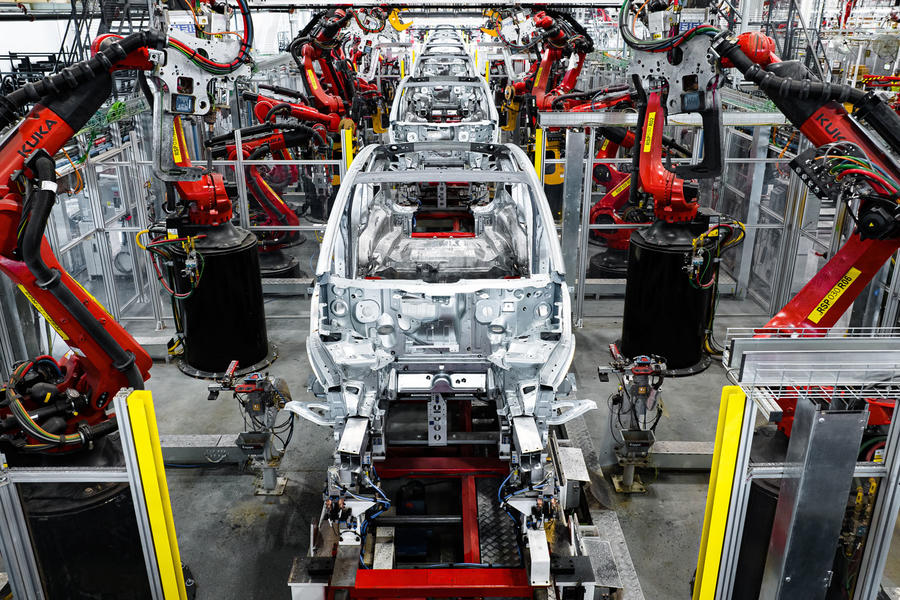

Tesla is making cars cheaply now, especially in China. “Shanghai has our lowest cost structure in the world,” Tesla CEO Elon Musk said on its earnings call for its first-quarter results. China also has one of the most mature battery supply chains and access to the cheaper lithium-iron-phosphate (LFP) battery technology, which has helped reduced battery costs.

So while the price cuts are undoubtedly hurting and will likely bring about the demise of some of China’s less well-funded EV brands (as well persuading more foreign brands to leave altogether), we’re also seeing EV pricing getting close to those of ICEs.

The question is how much of that will come to Europe. BYD has no plans to bring its Chinese pricing strategy over here, with Luo saying the company wanted to exploit a “brand premium” to price at a higher level.

Right now, the MG 4 EV is the only Chinese-made EV that offers significantly cheaper prices than local competition. That might change if Chinese pricing continues on the same aggressive level.

Source: Autocar